MORE Banking Upgrades FAQ

Our launch date will be May 13, 2024. This will require us to close our offices on Friday, May 10, 2024, for our systems to upgrade. In the meantime, we’ll be providing you with more information and resources to help you familiarize yourself with the new features and benefits.

Remote deposit services will be disabled as of May 8, 2024, at 4 pm EST. Any deposits that you will need to make between the cutoff time and the relaunch time of May 13, 2024, will need to be made on May 9, 2024, by 4 pm EST, either in the branch or by mobile deposit.

ACH originations will no longer be able to be scheduled with an effective date later than May 10, 2024. All ACH activity that will need to be processed with an effective date of May 13, 2024, will need to be re-uploaded into the new online banking that day and will be processed as same-day files. Please contact ach@fnbpasco.com for any specific questions that you might have.

Some features may not be available during the systems upgrade (such as mobile check deposit), however, payments and utilizing payment methods (such as checks, debit cards, and credit cards) will still be processed. We’re confident that these upgrades will further strengthen our partnership and empower you to achieve your financial dreams.

Your online banking login may change; however, our team is working hard to ensure a seamless transition. Any changes to your online banking username will be communicated to you prior to conversion.

As part of the conversion process, you will be required to download our “new” mobile app, which will be available in your app store. You will also need to set up your login information after you download the new app.

Yes. When you login to your online banking for the first time post-conversion, you will have to establish new security questions.

Our implementation team is working to transfer payees over to our new online banking platform; however, you may have to set up your payees on our new platform.

Your transaction history may not be immediately available on Monday, May 13, but our team will be working hard to import your transactions as quickly as possible.

Yes! As part of the conversion, you will have a budgeting tool available to you on your online banking dashboard. You will be able to set savings goals and create spending categories to help you achieve your American Dream.

No, your account number or numbers will not change. If you have checks, you will still be able to use them as you do today.

You will receive two statements for May 2024. Your first statement will be dated May 8, which is the last day we will utilize our old vendor. You will also receive a statement after the conclusion of the month, which will encompass all transactions from May 8 through May 31. Going forward, your statement will be available at the end of each month on your checking account(s). If you have a savings account, those statements will be available after the end of each quarter (March, June, September, and December).

Yes, you will still be able to use your debit card. However, during the conversion weekend, we will be operating in an “offline” status, which means that your daily transaction limit will be lowered. Your ATM limit will be $200, and your point-of-sale (POS) limit will be $500.

Your current debit card will work through the end of May, and you should have your new debit card before the end of the month. If you do not receive your new debit card, please notify us immediately.

Our core processor, which our employees use every day to serve our customers, is being converted. The core conversion is an upgrade and an enhancement that will allow us to better serve our customers.

Our new core system will be “live” beginning Monday, May 13, 2024.

Absolutely nothing! Our conversion team has been working hard for the past several months to ensure that our customers will not be negatively impacted by the change.

Jack Henry & Associates (JHA) will be our new core processor. By switching to JHA, we will be able to serve our customers more effectively and efficiently.

Your in-branch experience will not change at all. For users of our online banking and/or our mobile app, you will see a few changes in the look and layout of your home screen. The new online banking will offer you the same or better functionality that you have come to expect from your current experience.

Online Banking Login Changes

Beginning Monday, May 13, 2024, due to our core system upgrade, current First National Bank of Pasco customers' website logins will change.

----------------------------------------------------

Debit Cards

Beginning Friday, May 10th through Monday, May 13, 2024, your current debit card will have offline limits of $210.00 in cash per day and $500.00 point of sale limits per day. Bill payments and deposits will be posted to your account as of the close of business on Thursday, May 9, 2024.

Digital Services

Access to digital services will end on Thursday, May 9, 2024, at 4:00 pm (EST) and restart on Monday, May 13, 2024, at 7:30 am (EST). As part of the conversion process, you will be required to download our "new" mobile app, which will be available in your app store. The new app for both personal and business accounts is called FNB Pasco Mobile. You will use your existing login information after you download the new app. Please note that you will need to set up Account Alerts again in the new Mobile Banking app. Alerts previously established in the old system have not automatically carried over.

Bill Pay ACH

Our implementation team is working to transfer payees over to our new banking platform; however, you may have to set up your payees on our new platform beginning Monday, May 13, 2024. Please review and compare your payees and payee schedules.

Statements

Statements for deposit customers will be cut from our current core system on Thursday, May 9, 2024, and distributed in the way you currently obtain them. With the new system changes, all statements for checking will begin to drop at the end of the month cycle, which means you can expect to get two statements in the month of May. If you did not get a chance to obtain your digital statement prior to cutoff, please contact customer service, and they will be able to provide one through the new online banking system.

Customer Service

We are committed to delivering exceptional service and are eager to hear about your needs. Learn more about the beneficial changes coming by visiting this informative webpage: https://www.fnbpasco.com/more

Get everything you need from a bank and MORE...

We are committed to providing you with the most convenient and secure banking experience possible, which is why we are investing in significant upgrades to our banking systems, including both electronic banking and cash management options.

Enhanced Online and Mobile Banking

Easy Interface: Navigate your bank accounts on a modern, user-friendly, customizable platform.

Expanded Features: Enjoy a wider range of capabilities including faster bill pay, mobile check deposit, sending money to friends or family, and personalized financial insights.

Enhanced Security: Rest assured, knowing that your financial information is protected with the latest industry-leading security measures.

Streamlined Cash Management

Upgraded Visibility: Gain real-time access to your cash flow and transaction details across all of your accounts.

Automated Workflows: Simplify your business processes with automated payments, collections, and reconciliation tools.

Advanced Reporting: Gain valuable insights into your financial performance with comprehensive reporting options.

These upgrades are designed to

Save Time: Manage your finances efficiently from anywhere, at any time.

Increase Control: Gain greater administration over your financial activities.

Peace of Mind: Enjoy knowing that your banking information is protected with the latest industry-leading technology.

Alert - Initial Setup

Alert - Initial Setup Website Communication

Website Communication Mint Conversion Information

Mint Conversion Information Quickbooks Desktop Conversion Instructions

Quickbooks Desktop Conversion Instructions Quickbooks Online Conversion Instructions

Quickbooks Online Conversion Instructions Quicken Conversion Instructions

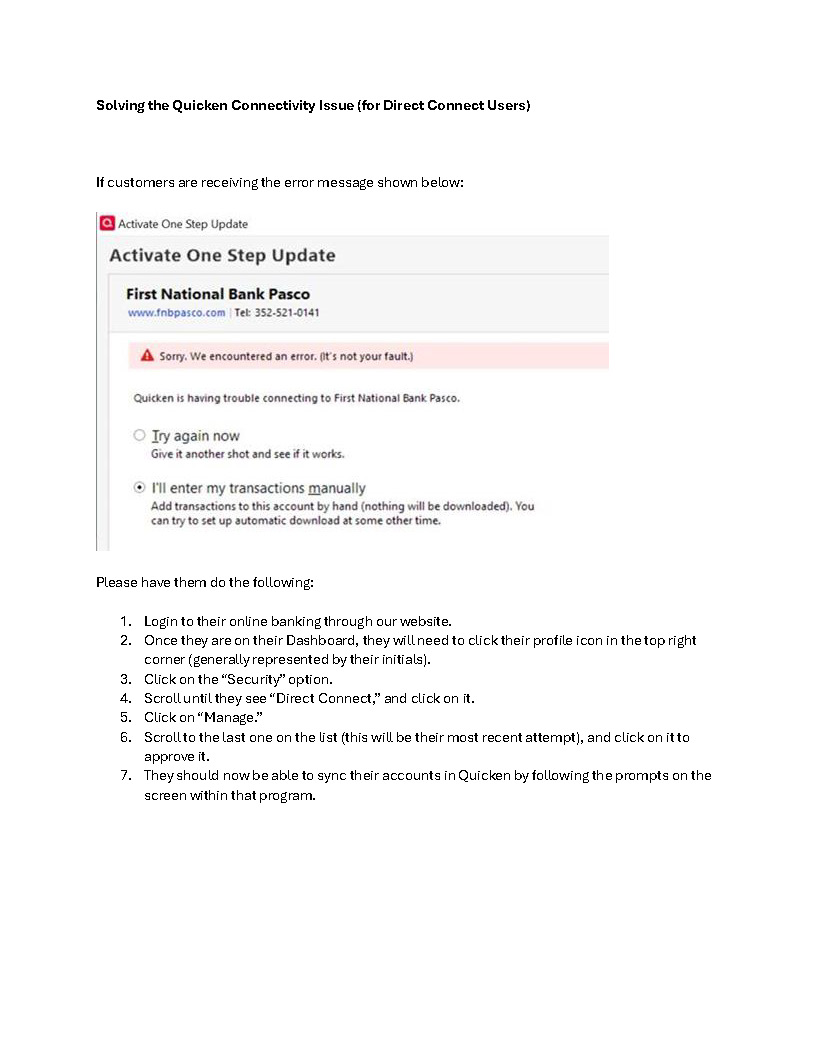

Quicken Conversion Instructions Solving the Quicken Connectivity Issue

Solving the Quicken Connectivity Issue ACH User Guide

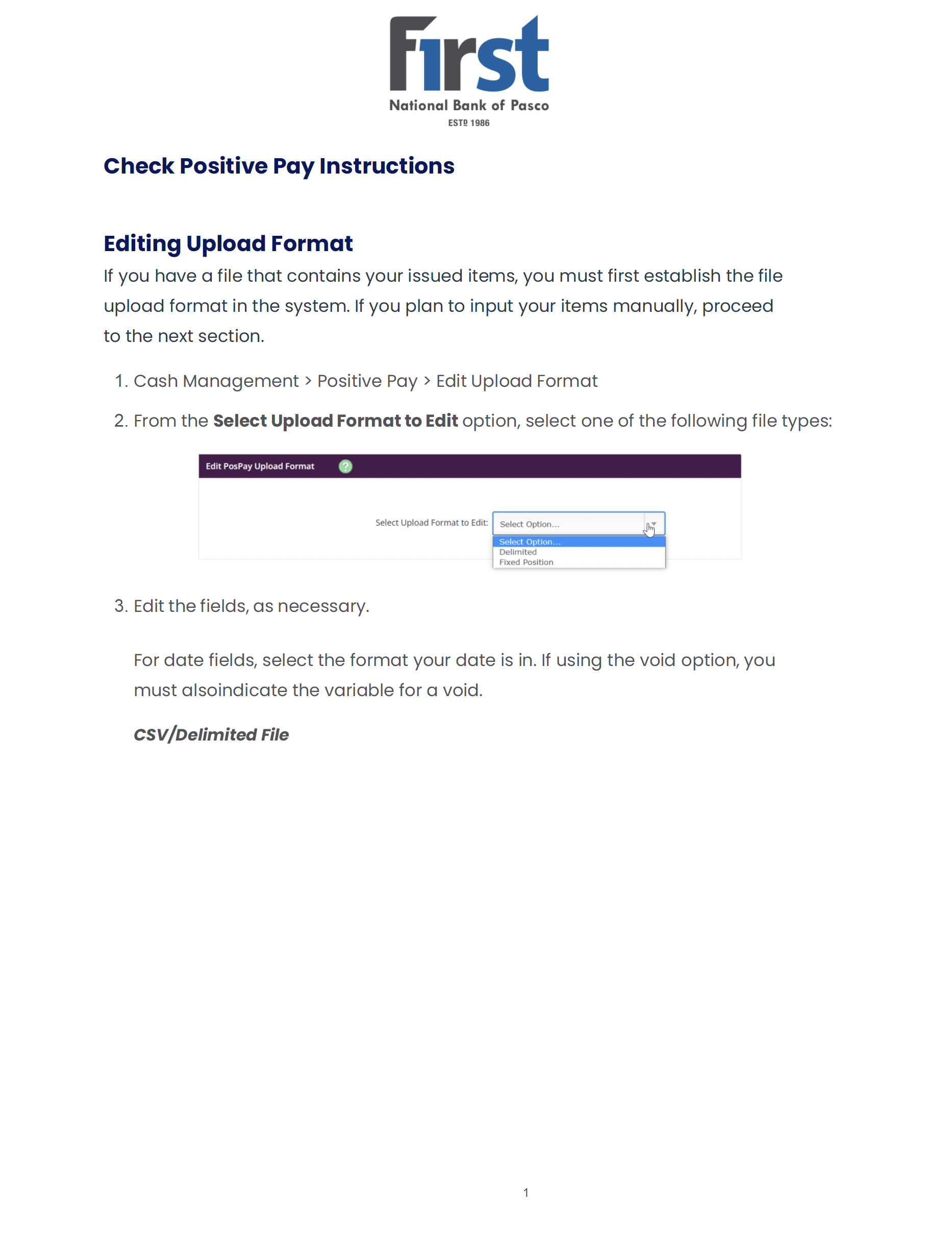

ACH User Guide Check Positive Pay Instructions

Check Positive Pay Instructions ARP User Guide

ARP User Guide ARP ACH Exceptions

ARP ACH Exceptions